Aug 16, 2022

The recently-passed Inflation Reduction Act (IRA) will reduce budget deficits by roughly $275 billion while pushing fiscal policy in the right direction to assist the Federal Reserve in its fight against inflation. However, a possible announcement from the White House to offer across-the-board student debt cancellation could undermine the bill’s disinflationary gains and deficit reduction.

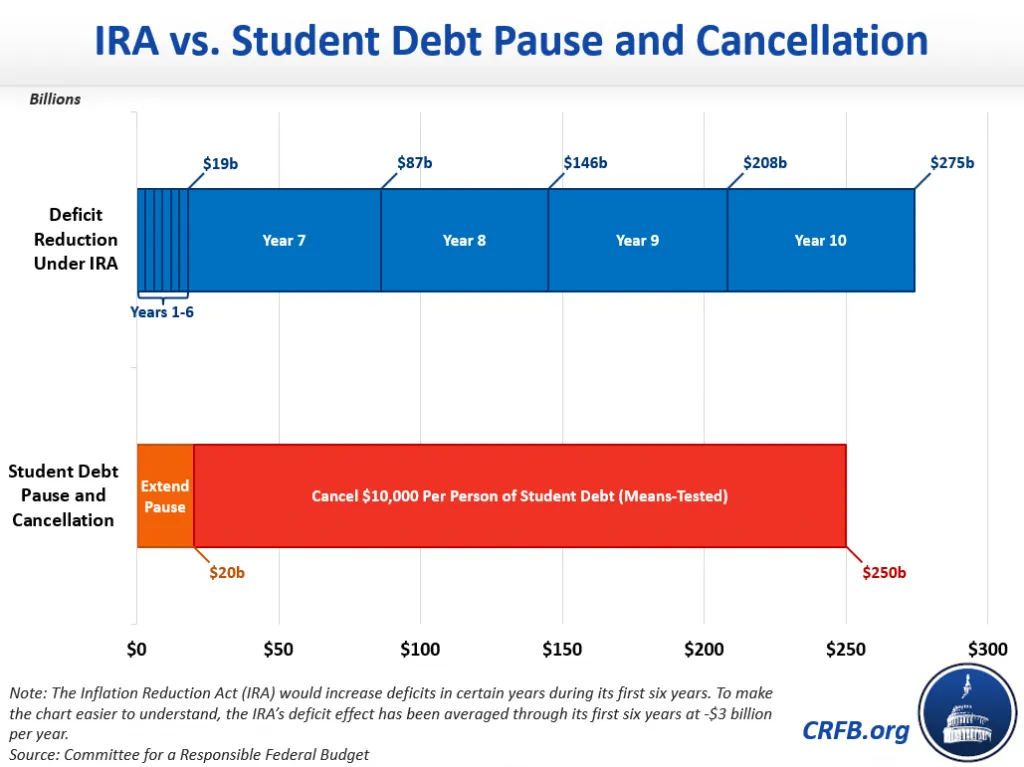

Simply extending the current repayment pause through the end of the year would cost $20 billion ・equivalent to the total deficit reduction from the first six years of the IRA, by our rough estimates. Cancelling $10,000 per person of student debt for households making below $300,000 a year would cost roughly $230 billion. Combined, these policies would consume nearly ten years of deficit reduction from the Inflation Reduction Act.

Debt cancellation would also wipe out the disinflationary benefits of the IRA. The Congressional Budget Office, Penn Wharton Budget Model, and Moody’s Analytics all found the IRA would have virtually no effect on inflation in the near term at the macroeconomic level. Our analysis is somewhat more optimistic since the bill’s micro-economic effects and side deals related to permitting and energy explorations can put downward pressure on prices.

However, debt cancellation would boost near-term inflation far more than the IRA will lower it. We previously estimated that a one-year pause could add up to 20 basis points to the Personal Consumption Expenditure (PCE) inflation rate. Using a similar analytical method, $10,000 of debt cancellation could add up to 15 basis points up front and create additional inflationary pressure over time.

Although there was no inflation in the month of July, inflation has surged at record levels over the past year and core inflation remains well above target.

The IRA gave Washington an opportunity to show it was finally serious about helping the Federal Reserve tackle inflation and begin to address our $24 trillion national debt.

Broad student debt cancellation ・whether by extending the pause, forgiving balances, or both ・would undermine the benefits of the IRA and demonstrate a lack of seriousness in addressing our nation’s economic challenges.